Having examined markets, recurring revenue and customer acquisition models, we’ll now explore a few persuasion tools that make it easy for businesses to charge more money.

1. Decoy Effect

This can be leveraged when there are two price considerations (say $66 per month & $21 per month). To make customers opt for the $66 p/m plan, create a third option (say $50 per month) close to your target price and leave a gulf in benefits between it and the $66 p/m option.

In this situation, the customer usually opts for the most expensive option ($66 p/m) to enjoy the full benefits of the product for only a few dollars more. The persuasion comes from perceiving the comparative advantage of this option against the $50 plan as much higher than the comparative advantage of the $50 plan over the $21 plan.

Alternatively, we can create a third price option (say $80) that is higher than our target price of $66 p/m. This new plan will have benefits similar to the $66 p/m option. In this case, also the customer opts for the cheaper option, settling on $66 per month.

Phew! If you spotted the decoy, don’t forget to leave a comment.

2. Center-Stage Effect

It is experimentally verified that humans have a knack for choosing the middle options when confronted with the responsibility of choice.

Not too much, not too little – just moderate.

This phenomenon is called the center-stage effect and it can help businesses using three (3) price tiers with the preferred option in the middle.

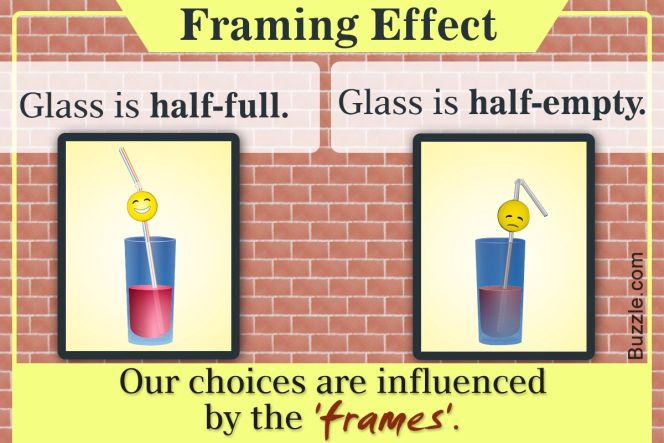

3. Framing Effect

It is a fact that people are most likely to support a cause if it is presented in positive terms.

As a result, using the framing effect means you’ll have to project the value of the customer’s choice not just their potential benefits.

As a rule, show the customer how much they can save by opting for the more expensive options e.g. Save $50 with an annual subscription, save $25 with a quarterly subscription.

4. Bandwagon Effect

If most people are opting for it, it must be the best option, right? For some dysfunctional reason, most of us answer in the affirmative. This is because of group-think – a psychological phenomenon that occurs within a group of people in which the desire for harmony or conformity in the group results in an irrational or dysfunctional decision-making outcome.

The trick is to design your price tiers and tag your preferred option as the “MOST POPULAR”

Incredible thoughts?

5. Base Rate Neglect

Often people judge that an outcome will occur without considering prior knowledge of the probability that it will occur i.e. most of us will only consider the price for an item only within the context of an immediate and applicable call to action on those prices at a given time.

Base rate flaw is noticed in the human tendency to make buying decisions based on prices in front of them rather than run comparisons with other similar products.

For example, a product that normally costs $3 is listed for $9 on a particular website, and the user goes ahead to pay without running a comparison.

6. Other hacks to charge more money easily.

-

i. Unique offerings: unique offerings with distinguishable from competition allows you charge more.

-

ii. Niche Promos: An approach that can be used is to create a niche discount and present this to some users that have crossed a determined milestone as an exclusive deal just for them.

-

iii. Money back guarantees over free trials: Instead of offering a 30 – day free trial, adopt a model like a 60 – day money back guarantee. If your product is great, you can expect comments like “ that 60-days didn’t seem like enough time”

-

iv. Discount Offers: Say we have a price option of $49 per month

An approach that was used at WP Engine to good effect was to write $79 (cross it out) and then write $49.

NB: Most businesses develop a pricing strategy using a suitable combination of the effects above

Remember, “Price reduction is not a competitive strategy, always seek options that make it easy to charge a lot of money”.

And this concludes our three parts series about unlocking predictable acquisition of recurring revenue with annual repay in a good market.